Join WhatsApp Group

Join NowIf you’re searching for steady, reliable income from stock investments, dividend-paying stocks can be your financial backbone. In 2025, Indian investors have a robust selection of high-dividend-yield stocks across multiple sectors—energy, finance, FMCG, IT, and infrastructure. These stocks not only offer regular payouts but also historically demonstrate strong financial performance and resilience in uncertain market conditions.

Key topics covered in this article:

Why Invest in Dividend-Paying Stocks?

- Regular Income: Generate a passive income stream through regular dividend payouts.

- Financial Stability: Dividend-paying companies are often well-established and less volatile.

- Potential Capital Growth: Alongside dividends, stock prices can appreciate over time.

- Inflation Hedge: Dividends may grow with inflation, protecting purchasing power.

- Compounding Effect: Reinvested dividends accelerate growth through compounding returns.

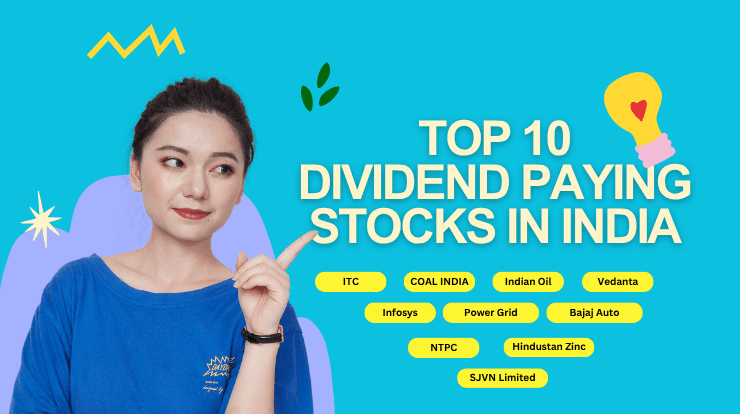

Top 10 Dividend Paying Stocks in India (2025)

1. Coal India Limited (CIL)

- Sector: Energy / Mining

- Dividend Yield: ~8%

- Why it’s top: World’s largest coal producer with consistent profits.

- Strength: Robust cash reserves, steady government contracts.

2. Indian Oil Corporation (IOC)

- Sector: Oil & Gas

- Dividend Yield: ~7%

- Why it’s top: Industry leadership, diversified operations, strong government support.

- Growth Focus: Investments in renewables and petrochemicals.

3. Power Grid Corporation of India

- Sector: Utilities

- Dividend Yield: ~6.5%

- Why it’s top: Monopoly in transmission with long-term government agreements.

- Stability: High cash flow, low default risk.

4. Bajaj Auto

- Sector: Auto

- Dividend Yield: ~6%

- Why it’s top: Market leader in two-wheelers and three-wheelers.

- Dividend Policy: Generous payouts supported by high profits.

5. NTPC Limited

- Sector: Power

- Dividend Yield: ~5.8%

- Why it’s top: Largest power utility with a broad portfolio of power plants.

- Future Ready: Expanding into renewable energy.

6. Hindustan Zinc

- Sector: Mining / Metals

- Dividend Yield: ~5.5%

- Why it’s top: Efficient producer with healthy profit margins and global presence.

7. Infosys

- Sector: IT Services

- Dividend Yield: ~4.8%

- Why it’s top: Renowned IT company blending capital growth and regular dividends.

- Innovation: Continuous investment in digital services.

8. SJVN Limited

- Sector: Power (Hydro)

- Dividend Yield: ~4.5%

- Why it’s top: Stable payouts, government-owned, focuses on clean energy.

9. ITC Limited

- Sector: FMCG / Conglomerate

- Dividend Yield: ~4.2%

- Why it’s top: Diverse portfolio including FMCG, hotels, and agriculture.

- Brand Power: Sector leadership fosters payout stability.

10. Vedanta Limited

- Sector: Mining / Metals / Oil & Gas

- Dividend Yield: ~6-8% (varies annually)

- Why it’s top: Multi-commodity natural resources company with frequent high payouts.

Comparison of Top Dividend Paying Stocks in India (2025)

Dividend yield values are approximate for 2025; Market cap values may fluctuate.

Pros and Cons (Key Points)

Pros

- Consistent cash flow from dividends.

- Financial safety as most are large-cap, blue-chip companies.

- Potential for capital appreciation in addition to dividends.

- Tax efficiency for long-term investors (up to certain limits).

- Ideal for retirees and conservative portfolios.

Cons

- Not immune to business cycles; profits/dividends may fluctuate.

- Dividend payout may reduce if company faces sectoral challenges.

- Opportunity cost: High dividend stocks sometimes offer lower price growth.

- Taxation on dividends (although reduced for small investors).

Frequently Asked Questions

What are the top 10 dividend paying stocks in India in 2025?

How often do these companies pay dividends?

Most pay annually or semi-annually, with special dividends in profitable years.

Are high-dividend stocks safe for beginners?

What taxes apply to dividends in India?

Dividends are taxed in investors’ hands at applicable slab rates (plus surcharge/cess).

Can I lose money with dividend stocks?

Yes, if the share price falls more than the dividends earned or if the dividend payout is reduced.

How do I buy these stocks?

You need a Demat and trading account; invest via stock exchanges or apps.

Dividend-paying stocks in India are a powerful tool for stable income, long-term growth, and portfolio diversification. From Coal India’s impressive payouts to ITC’s robust track record and Infosys’s blend of growth plus income, these companies present a viable path toward wealth creation.