Avance Technologies Ltd is a small IT player that’s been turning heads lately with some solid profits and no big debts hanging around. From what we see in recent numbers, they’ve got a market cap around ₹569 crore, with shares trading at about ₹2.92 as of October 16, 2025. Revenue hit ₹162 crore last year, and they’re posting profits like ₹4.73 crore, thanks to trading IT stuff and digital services. India’s IT world is booming—expected to jump to $350 billion by 2030 with 9-13% yearly growth in spots like software and cloud. But hey, this is a small-cap stock with low promoter stake (just 0.68%) and some ups and downs in sales, so long-term guesses are pretty much educated hunches. These Avance Technologies share price targets for 2026, 2030, 2040, and 2050 come from looking at different “what if” stories—like if they nail big contracts or hit snags. Bull stories bet on IT boom and smart moves; base ones figure steady plodding; bear ones worry about slowdowns or competition. Remember, nothing’s set in stone—market twists could change everything. Do your homework before jumping in.

Folks often chat about Avance Technologies share price targets when eyeing India’s hot IT scene, where digital stuff like cloud and apps is growing fast at 9-13% a year through 2030. This little company does trading in tech gear and helps with online marketing and software tweaks. But with its small size and spotty sales history, any Avance Technologies stock forecast feels like a bit of a gamble. We’ll break down a straightforward Avance Technologies future price 2030 view here, using simple scenarios and keeping it real about the ups and downs.

What is Avance Technologies?

Avance Technologies Ltd kicked off back in 1985 and keeps things simple: they trade IT products like gadgets and peripherals, plus whip up custom software and digital marketing tricks for businesses. Think SEO boosts, social media setups, and even SMS tools for banks or shops. It’s all about helping companies go digital without the hassle. They’ve got a lean setup in Mumbai, focusing on growth spots like e-commerce and cloud services.

Recent Financial & Market Status

Things are looking up a bit for Avance lately—they turned profitable after some rough patches, with no debt weighing them down for years now. Last year’s revenue was ₹162 crore, but sales dipped 16% in spots due to market jitters. Profits clocked in at ₹4.73 crore, and they’re not splashing out dividends yet, which some investors grumble about. Overall, it’s a turnaround story in a sector that’s firing on all cylinders.

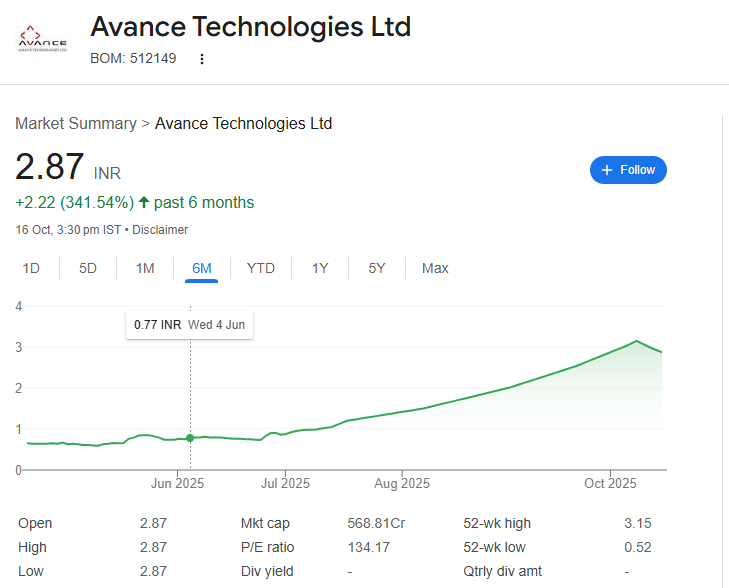

Current Share Price & Key Metrics

Right now, on October 17, 2025, Avance Technologies shares are hanging around ₹2.92 on the BSE, giving it a market cap of about ₹569 crore. Here’s the quick rundown on the numbers:

- Market Cap: ₹569 Cr

- Book Value: Around ₹1.50 (solid, no negatives here)

- Debt: Zero—super clean balance sheet

- P/E Ratio: 146 (kinda high, means folks are betting big on growth)

- ROE/ROCE: ROE about 1.4%; ROCE similar—room to improve

- Margins: Operating margins decent at 5-10%, but net profits vary

- Growth Trends: Sales up overall but quarterly dips (like 18% in Q1 FY26); stock jumped 238% in a year, though volatile

Risks Highlighted by Financial Reports

Watch out for low promoter holding—that 0.68% means big owners aren’t super committed, which can spook folks. Sales can swing wild (down 54% in one quarter), and with no debt but thin profits, any IT slowdown hits hard. Plus, competition from giants like TCS keeps the pressure on.

Why Forecasts for Avance Technologies Are Challenging

This is a tiny fish in a big pond—small-cap IT stocks like Avance bounce around a lot with few experts watching. They rely heavy on grabbing contracts in a crowded market, and stuff like global tech shifts or economic dips can flip things quick. Low institutional buys add to the guesswork.

We’re basing these Avance Technologies share price targets off today’s ₹2.92 price. Bull cases dream of nailing IT trends like cloud booms; base ones expect okay progress; bear ones brace for misses. We pulled CAGRs from sector vibes (8-13% growth) and their past ups.

Avance Technologies Share Price Targets 2026

- Bull Case (₹5.00): They snag big digital deals, sales jump 30%; quick 71% growth.

- Base Case (₹4.00): Steady trading wins; 37% bump.

- Bear Case (₹2.00): Sales stall on competition; down 32%.

Avance Technologies Share Price Targets 2030

- Bull Case (₹12.00): Ride $350B IT wave with smart expansions; 32% yearly ride.

- Base Case (₹6.00): Keep chugging at 15% growth.

- Bear Case (₹1.50): Tough times, -10% slide.

Avance Technologies Share Price Targets 2040

- Bull Case (₹50.00): Become a go-to for AI/cloud in a massive market; 15% long haul.

- Base Case (₹15.00): Hang in there at 10% pace.

- Bear Case (₹0.50): Fades if tech leaps over them.

Avance Technologies Share Price Targets 2050

- Bull Case (₹150.00): Global player in evolved IT; 12% steady climb.

- Base Case (₹30.00): Solid niche spot at 8%.

- Bear Case (₹0.00): Washed out by bigger fish.

| Year | Bull Case | Base Case | Bear Case | Key Assumptions |

|---|---|---|---|---|

| 2026 | ₹5.00 | ₹4.00 | ₹2.00 | Contract wins, IT demand up, or sales dips |

| 2030 | ₹12.00 | ₹6.00 | ₹1.50 | Sector boom, steady ops, or recession hits |

| 2040 | ₹50.00 | ₹15.00 | ₹0.50 | Long growth, execution wins, or tech shifts |

| 2050 | ₹150.00 | ₹30.00 | ₹0.00 | Innovation pays, basics hold, or wipeout |

Related Article:

- Winsome Yarns Share Price Targets for 2026, 2030, 2040, 2050

- Filatex Fashions Share Price Targets for 2026, 2030, 2040, 2050

- Future Enterprises Share Price Targets for 2026, 2030, 2040, 2050

- GTL Infra Share Price Targets for 2026, 2030, 2040, 2050

- Siti Network (SITINET) Share Price Target 2026, 2030

- Sanwaria Consumer (SANWARIA) Share Price Target 2025, 2026, 2030, 2040, and 2050

Factors That Could Drive or Derail Growth

- Drivers:

- IT explosion: India’s tech pie hits $350B by 2030, with cloud and apps leading.

- No debt freedom: Lets ’em chase deals without stress.

- Digital push: More businesses need SEO and software tweaks.

- Derailers:

- Big rivals: TCS or Infosys scoop the easy gigs.

- Market wobbles: Global slowdowns cut spending.

- Inside stuff: Low owner stake might mean less drive.

FAQs

Is Avance Technologies a good long-term investment?

Could be if you like bets on IT growth, but its small size and swings say “high risk” for most folks.

How realistic is ₹12 by 2030?

In a hot bull run with sector tailwinds, yeah—but base ₹6 feels more like it given their spotty sales.

What happens if the IT sector slows?

Bear mode kicks in hard—prices could tank as contracts dry up.

Can it handle any debt pressure?

No sweat—they’ve been debt-free for years, so that’s a plus.

Should small investors bet on such speculative stocks?

Only a tiny slice of your pot, and only if you’re cool with rollercoasters—stick to basics otherwise.

Conclusion

Wrapping it up, Avance Technologies share price targets show real spark from India’s IT rocket ride, but weak spots like low ownership and sales hiccups keep it grounded. Main takeaway: It all rides on grabbing opportunities and dodging potholes. These are rough sketches—dig into the details yourself and talk to an advisor before making moves.